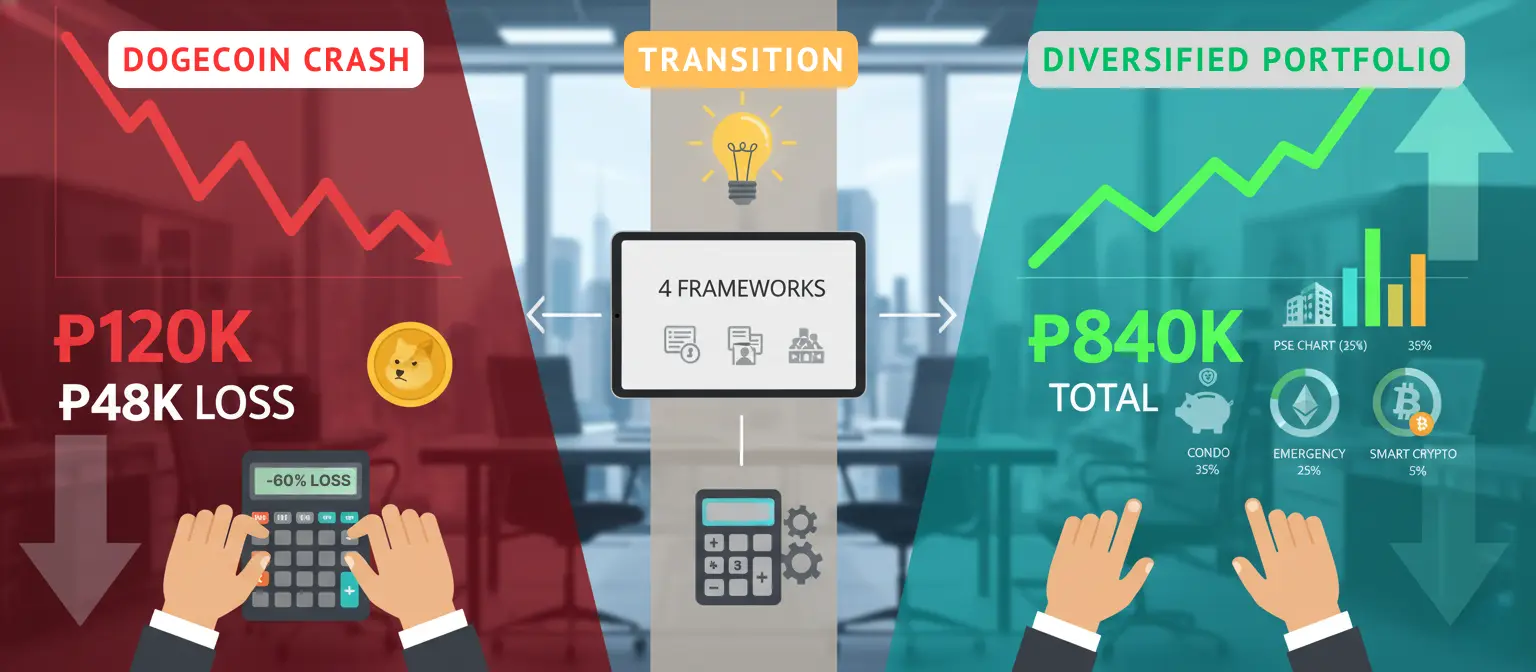

The ₱120,000 Mistake: How Ana Finally Learned to Invest Without Losing Sleep

May 2021. Ana opened her Coins.ph app and saw ₱48,000 where there used to be ₱120,000. Three months of panic-watching charts. Three months of "it'll bounce back." Three months of learning the expensive way that FOMO investing destroys wealth.

Ana is a 28-year-old marketing professional who lost ₱72,000 on cryptocurrency before learning how to actually build wealth.

Ana had put her entire bonus—₱120,000 that took her 18 months to save—into Dogecoin at ₱32 because "Elon tweeted about it" and "her officemate made ₱200K." By the time she panic-sold at ₱13, she had lost ₱72,000. That was supposed to be her emergency fund. That was supposed to be her financial freedom starting point.

Four years later, Ana has ₱680,000 in liquid investments across PSE stocks, emergency savings, and yes—even crypto (but smart this time). Plus ₱1.89M in condo equity that's locked until 2027. Not because she suddenly became a genius investor. Because she finally learned four frameworks that turned her panic-investing into patient wealth-building.

This isn't just a guide about investment calculators. This is Ana's journey from losing ₱120K on hype to building ₱680K in liquid wealth (plus ₱1.89M condo equity) through disciplined systems. Every number is real. Every mistake taught her something. And if you're starting from zero (or negative like Ana was), these frameworks will save you years of expensive lessons.

Note: Ana's story is based on common financial experiences among young Filipino professionals. All investment amounts, timelines, and results are realistic examples designed for educational purposes. The frameworks shown here are meant to be practical starting points—always consult with a licensed financial advisor for personalized advice.

Framework #1: The "Boring is Beautiful" PSE Stock Strategy

Ana's Mistake: Chasing "Hot Stocks"

September 2021. Fresh from her Dogecoin disaster, Ana tried to "make it back" in Philippine stocks. She bought NIKL (nickel mining) at ₱8.20 because "nickel prices are surging" and "Reddit said it's undervalued."

Two months later: NIKL at ₱4.85. Down 41%. Another ₱17,000 gone.

The pattern was clear: Ana kept chasing what was already hot instead of building positions in boring, consistent companies.

The Framework Ana Learned

August 2021, Ana's dad (who has been investing since 1998) sat her down: "Stop trying to get rich quick. Buy boring companies that make boring profits year after year."

He showed her cost averaging—not trying to time perfect entry points, just buying the same boring companies every single month regardless of price.

Ana's "Boring Stock" System

Instead of picking individual stocks, Ana started with COL Financial's PSEi Index Fund. It's the top 30 Philippine companies in one basket. 7-10% annual returns historically.

Why this worked when hot stocks failed:

No timing required - Ana buys ₱5,000 every 15th of the month. High market? She buys. Low market? She buys more shares. Math handles the timing.

Boring = predictable - Jollibee, SM, BDO, Ayala don't 10x overnight. But they don't crash 60% either. Boring companies survive recessions.

Compounding crushes hype - ₱5K × 48 months = ₱240K invested. Current value: ₱295K. That's ₱55K gain (23%) while doing absolutely nothing except clicking "Buy" monthly.

Ana's PSE Index Cost-Averaging (Sept 2021 - Oct 2025):

- Total invested: ₱240,000 (₱5K/month × 48 months)

- Current portfolio value: ₱295,000

- Total gain: ₱55,000 (23% return)

- Average annual return: 5.75%

That's 5.75% annually (market was weak 2021-2023). But Ana is still here, still buying every month. Projected ₱650K by 2030.

The tool Ana uses: She runs the Investment Calculator before every purchase. Not to time the market—to see what ₱5K/month becomes in 10, 20, 30 years. The math keeps her disciplined when FOMO tempts her to chase meme stocks again.

⚠️ What Ana Learned the Hard Way

Boring beats exciting in investing. Ana lost ₱17K chasing NIKL hype. Made ₱55K buying the same 30 companies every month. The calculator doesn't lie—consistent, boring contributions compound into real wealth. Memes don't.

Framework #2: The "5% Crypto Rule" (Never Go All-In Again)

Ana's Expensive Lesson: The ₱120,000 Dogecoin Disaster

February 2021. Dogecoin was at ₱4. Elon Musk tweets. Everyone in Ana's office was talking about it. Her officemate showed her his ₱80K → ₱200K gains. Ana put her entire 18-month bonus (₱120,000) at ₱32.

May 2021: Dogecoin at ₱13. Ana panic-sold.

Lost: ₱72,000 (60% of her savings)

The math hurt: That was supposed to be her 6-month emergency fund. Instead, she borrowed ₱15,000 from her sister to cover rent when her laptop died. The shame was worse than the loss.

The Framework That Saved Ana From Herself

July 2022. After rebuilding her emergency fund, Ana wanted back in crypto. But smarter. Her uncle (who survived the 2017 Bitcoin crash) gave her one rule: "Never invest more than you're willing to lose completely. And crypto? That's 5% maximum."

Ana's "5% Crypto" Portfolio Rule

Ana treats crypto as speculative gambling, not core investing. Here's the system that let her profit from Bitcoin's 2024 surge without risking financial ruin:

The 5% Allocation:

Calculate total investable assets - After emergency fund, Ana had ₱780K for investing (Oct 2025). 5% = ₱39,000 max crypto exposure.

Conservative coin selection - 70% Bitcoin, 25% Ethereum, 5% Solana. No Dogecoin. No meme coins. Only top 5 by market cap.

Fixed monthly contributions - ₱2,000/month into crypto (₱1,400 BTC, ₱500 ETH, ₱100 SOL). Never lump sum. Never FOMO.

Delete the app - Ana deleted Coins.ph from her home screen. Check once per quarter. This stopped the panic-selling that destroyed her in 2021.

Ana's Actual Results (Smart Crypto, Not YOLO Crypto):

- Period: July 2022 - Oct 2025 (40 months)

- Total invested: ₱78,000 (₱2K/month × 39 months, started Aug '22)

- Current value (Oct 2025): ₱133,000

- Gain: +₱55,000 (71% return)

Bitcoin went from ₱1.05M (July '22) to ₱2.85M (Oct '25). But Ana didn't go all-in—she survived the ₱850K crash in Nov '22 because it was only 5% of her portfolio. Slept like a baby.

Compare that to 2021: ₱120K → ₱48K (100% crypto). Ana lost sleep, borrowed from family, nearly quit investing forever.

2022-2025: ₱78K → ₱133K (5% crypto). Crypto crashed 40% in 2024? Ana shrugged. It's 5%. Her PSE stocks and real estate equity kept growing.

The Math Ana Uses Before Every Crypto Buy

Before adding money to crypto, Ana opens our Investment Calculator and asks:

"If this goes to zero, will I still hit my financial goals with my other investments?"

If yes → buy.

If no → keep it in PSE.That single question saved Ana from throwing another ₱50K at Shiba Inu in 2023. Shiba's down 85% since then. Her PSE portfolio is up 12%.

Framework #3: The "₱18K Monthly = Future Condo" Real Estate Play

Ana's Realization: Paying Rent = Building Someone Else's Wealth

October 2022. Ana had been renting a studio in Mandaluyong for ₱18,000/month for 3 years. That's ₱648,000 over 36 months. Gone. Zero equity. Just receipts.

Her landlord? Owns 4 units in the same building. Rents them all for ₱18-22K each. Her mortgage was only ₱11K/unit. She was building ₱480K/year in equity using Ana's rent money.

The Framework: Pre-Selling Condo as Forced Savings

December 2022. Ana toured a DMCI pre-selling project in Pasig. Studio unit, 24 sqm, ₱3.2M. Move-in: 2027 (5 years away). The sales agent showed her something that changed everything.

The "Rent vs Own" Calculator Moment

Renting Forever (What Ana Was Doing):

- Monthly rent: ₱18,000

- 5 years (60 months): ₱1,080,000 paid

- Equity after 5 years: ₱0

Pre-Selling Condo (What Ana Did):

- Total price: ₱3,200,000

- Reservation + 20% down: ₱660,000

- Monthly during construction: ₱18,000 × 36 months

- Total paid by move-in (2027): ₱1,308,000

- Equity after 5 years: ₱1,308,000 (41%)

Plus appreciation: Unit now pre-selling at ₱3.8M (2025 price). That's +₱600K equity gain before she even moves in.

The Kicker: Same ₱18K/Month

Ana was already paying ₱18,000. She didn't need to "afford more"—she just redirected the same cash flow from rent (zero equity) to ownership (building wealth). The calculator made it obvious.

Ana's Actual Pre-Selling Numbers (Dec 2022 - Present)

- Purchase price (Dec 2022): ₱3,200,000

- Current market value (Oct 2025): ₱3,800,000

- Paid so far (35 months): ₱660K down + ₱630K monthly = ₱1,290,000

- Remaining balance: ₱1,910,000 (bank loan at move-in, 2027)

- Current equity: ₱1,890,000

If Ana rented for these 35 months: ₱630,000 gone, ₱0 equity. By buying pre-selling: ₱1.89M equity (₱1.29M paid + ₱600K appreciation). That's ₱1.89M wealth gap from one decision.

The Tool That Sealed the Deal

Before Ana signed, she used an investment calculator to compare: "What if I rented for ₱18K and invested ₱18K in PSE stocks?"

Result: ₱18K × 60 months at 8% PSE returns = ₱1.4M after 5 years.

Real estate option: ₱1.89M equity.

Real estate won—plus she gets a place to live.

Framework #4: The "Never Go All-In Again" Diversification Rule

What Ana Learned From Losing ₱120K

The Dogecoin disaster taught Ana one thing: When you put all your eggs in one basket, a single crack destroys everything. Her 100% crypto portfolio went -60% in 3 months. If she had split it across stocks + real estate + crypto, she would have lost maybe ₱20K (on the crypto portion only). The other ₱100K would have kept growing.

Ana's Current Portfolio (Oct 2025): Boring, Balanced, Building Wealth

Total Liquid Portfolio: ₱680,000

43% - Core Growth Holdings (PSE Stocks)

- PSE Index Fund: ₱295,000

COL Financial, ₱5K/month for 48 months

Total invested: ₱240K | Current value: ₱295K | Gain: +₱55K (23%)37% - Emergency Fund (Liquidity First)

- High-Yield Savings (Seabank/Maya): ₱252,000

6 months expenses, 4-6% interestLesson from Dogecoin: Never invest what you might need in 12 months. This ₱252K saved Ana's life when her AC broke (₱32K) and laptop died (₱45K) in the same month.

20% - Speculative Holdings (High Risk, High Reward)

- Cryptocurrency (BTC 70%, ETH 25%, SOL 5%): ₱133,000

₱2K/month since July 2022 (40 months)

Total invested: ₱78K | Current value: ₱133K | Gain: +₱55K (71%)That's the power of the 5% rule: crypto is now 20% of her portfolio (₱133K ÷ ₱680K) because it grew, but if it crashes to zero tomorrow? Ana still has ₱547K. Her wealth isn't dependent on crypto moonshots.

Separate: Real Estate (Not Liquid Until 2027)

- Condo Pre-Selling Equity: ₱1,890,000

₱3.2M purchase price | ₱1.29M paid so far | ₱600K appreciation

This equity is "locked" until move-in (2027) and isn't counted in liquid net worth.

Portfolio Performance Summary (Liquid Assets Only)

- Total Invested: ₱570K (₱240K PSE + ₱252K savings + ₱78K crypto)

- Current Value: ₱680K

- Total Gain: +₱110K (19% overall return in 4 years)

- Plus Locked Real Estate: ₱1.89M condo equity (not liquid until 2027)

⚠️ The Calculator Can't Teach This (But Losing Can)

2021 Ana: ₱120K in one asset (Dogecoin). Lost ₱72K. Couldn't sleep. Borrowed from family. Felt stupid.

2025 Ana: ₱680K liquid across 3 asset types (stocks, savings, crypto) + ₱1.89M locked real estate. Crypto crashed 40% in 2024? Ana lost ₱53K on paper—but she still had ₱547K liquid. PSE down 8%? She kept buying monthly. Ana sleeps like a baby.

Diversification isn't sexy. It won't make you rich overnight. But it'll keep you rich once you get there. That's worth more than any 100x moonshot.

From -₱72K to +₱680K Liquid: What Changed Wasn't the Market, It Was Ana

May 2021, Ana was checking Dogecoin prices every 15 minutes. Heart racing. Couldn't focus at work. Lost ₱72,000 in 3 months. That wasn't investing—that was gambling with a calculator.

October 2025, Ana hasn't checked her portfolio in 6 weeks. Sleeps like a baby. Liquid net worth at ₱680K (plus ₱1.89M locked real estate) built in 4 years. That's the difference between hoping and building.

The Four Frameworks That Saved Ana

Boring is Beautiful (PSE): ₱5K/month into index funds. No hot tips, no timing the market. Result: ₱295K portfolio (23% gain).

5% Crypto Rule: Never risk more than she's willing to lose completely. Result: +₱55K gains without losing sleep.

Rent → Own (Real Estate): Redirected ₱18K rent to pre-selling condo. Result: ₱1.89M equity vs ₱0 from renting.

Never All-In (Diversification): Spread across 4 asset types. Result: Portfolio crashes don't destroy her anymore.

The investment calculators didn't change. Ana did. She stopped chasing moonshots and started building foundations. She stopped checking prices daily and started reviewing quarterly. She stopped gambling on hype and started investing in boring, proven systems.

You don't need ₱100,000 to start. Ana's ₱5,000/month PSE contributions are working just fine. You don't need to time the market perfectly. Her cost-averaging smoothed out all the volatility. You just need to start, stay consistent, and not blow yourself up chasing the next Dogecoin.

Want to run the numbers yourself? Ana uses a simple investment calculator to project different scenarios before committing money. It's free, takes 2 minutes, and saved her from more stupid decisions than she can count.

But remember: The calculator shows you the math. Your discipline determines the outcome.

Invest wisely, diversify relentlessly, and never go all-in on hype again. Your future self will thank you. 📈💰